How to Buy Insurance / How much insurance for the worst of times?

A Review Of Disaster Calculators

If you find yourself drawn to online calculators or forecasting widgets like DQYDJ or SmartAsset, then this article is for you.

Written by: Gabriel Botelho Reviewed by: Max Cho, Licensed Insurance Broker NPN 20377411

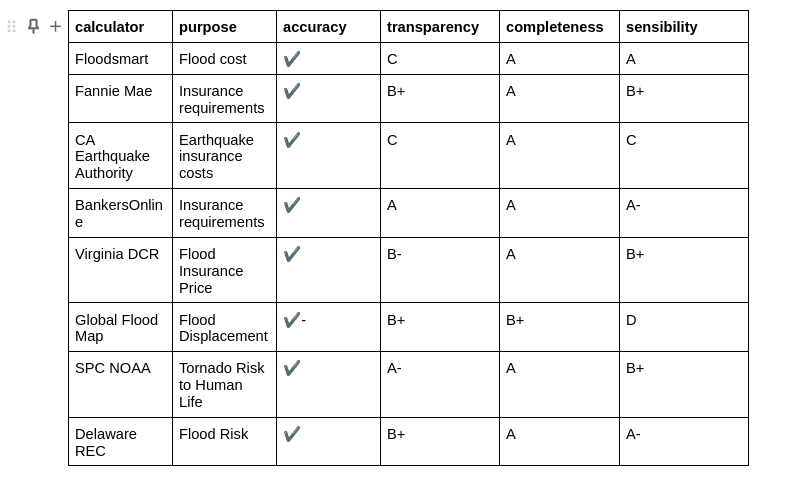

A good online calculator has four things:

- Accuracy

- Completeness, or a full set of inputs and outputs

- Transparency, as to how calculations are made

- Sense, it chooses good defaults for inputs based on the intended user and is it easy to navigate

We’ve gathered some of our favorite natural disaster calculators to see how they hold up to these criteria and some more general thoughts on usability and bugs.

Flood Cost Calculator

by FEMA Floodsmart

This is a disaster calculator with one goal: get users to understand flood costs. It has two inputs: a three-option choice for home size and a flood level toggle. It's simple, gives live feedback, and has an understandable illustration. Great purpose-built calculator.

If there’s a problem with it, it's that the call to action doesn’t just point users to Coverage Cat for a faster and more optimized buying experience than navigation across a multi-menu state-by-state flood insurance provider tool.

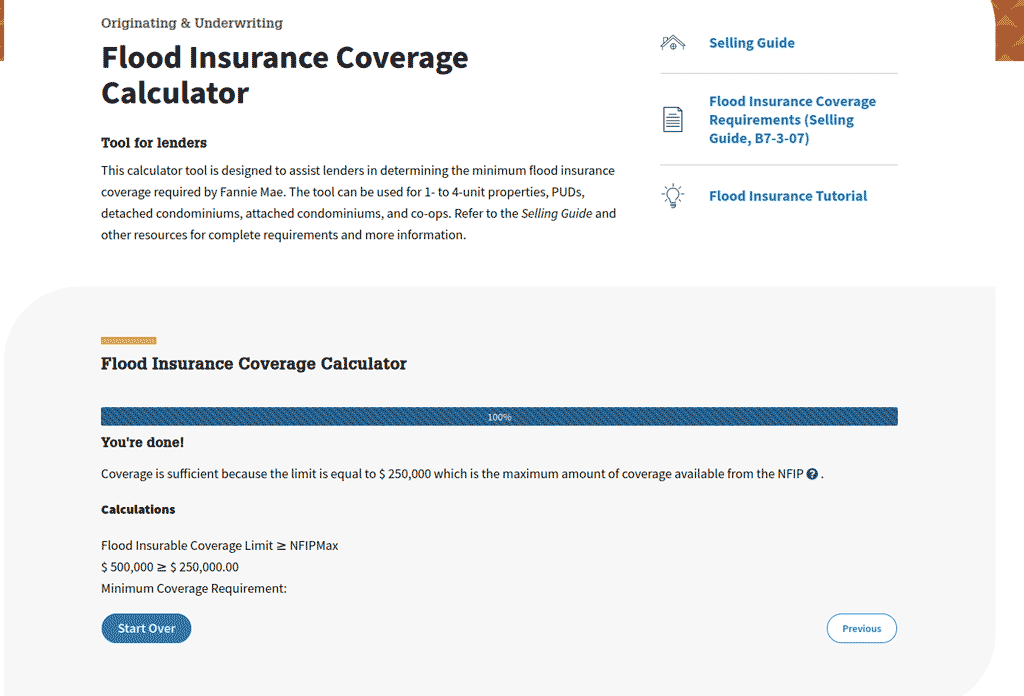

Minimum Flood Coverage Calculator

by Fannie Mae

This Fannie Mae calculator has a narrower purpose than most other tools on the list. Its stated intention is to help lenders ensure a property has the coverage required for a Fannie Mae supported mortgage. The inputs require property information and value plus current/intended insurance coverage. The output is a Sufficient/Not Sufficient declaration that informs the lender if the property has enough flood insurance coverage.

The calculator succeeds, because it provides a clear go/no-go signal and does so with limited user time investment, few questions, and high explainability in the form of a Calculations tab. All good lessons for the Coverage Cats ;).

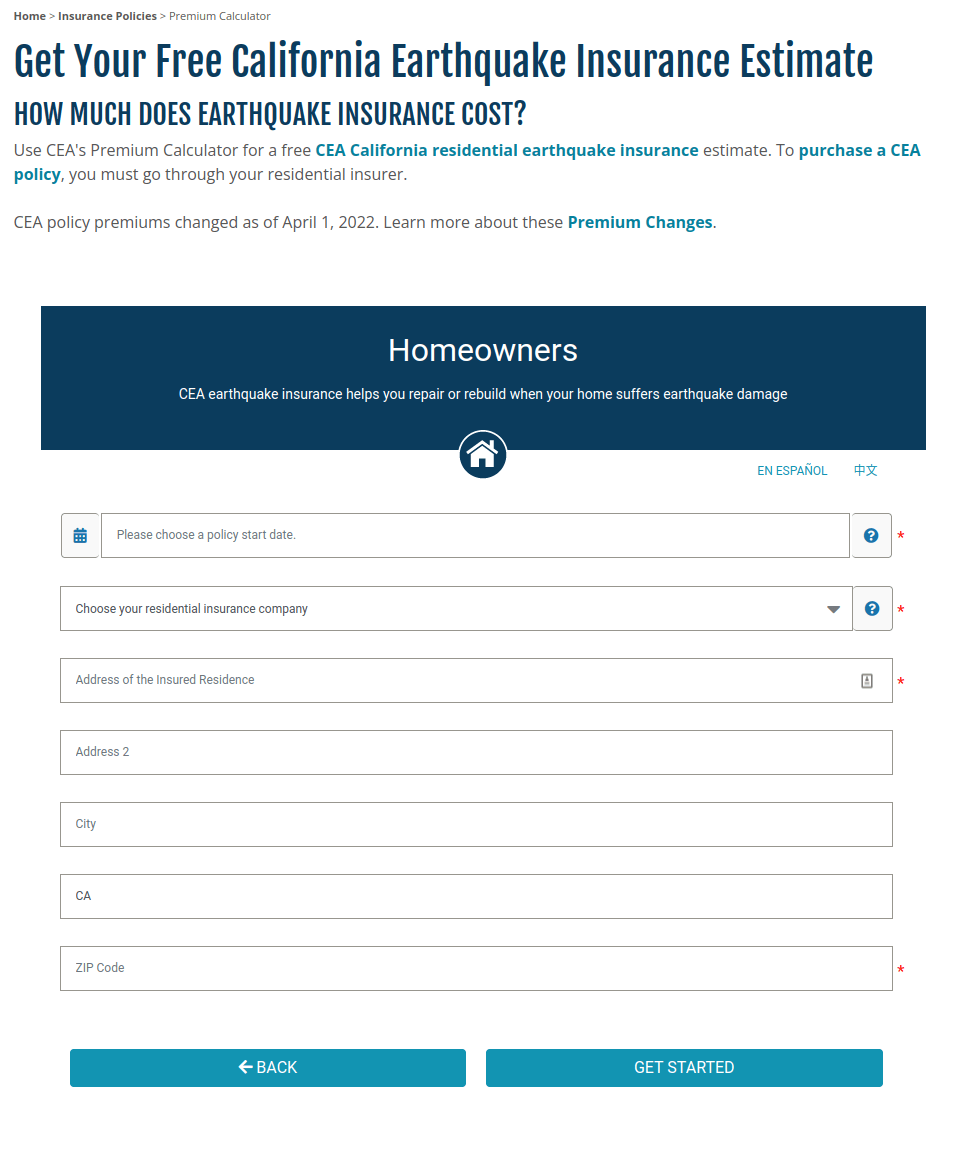

Earthquake Insurance Premium Calculator

by the California Earthquake Authority

The California Earthquake Authority– a “not-for-profit, publicly managed, privately funded entity”– built a tool with a great calculator aesthetic: white background, readable buttons, a parseable form. It also concludes with a price, always a plus in our book.

However, once you share your address– a process that requires two dummy forms that go unused in the final output– problems start to mount. Why does cost estimation at this level require information about an insurer? Does this tool check against a set of filed rate cards for one company? Or across companies? What exactly does that price gauge show? Is it helping the user compare their cost across the insurance category?

Strange choices about how to describe deductibles and property coverage options are also off-putting. Personal property coverage is capped at $200k for both renters and homeowners while loss of use coverage is capped at $100k. These might seem generous, but it should be easier for homeowners who live in an earthquake sensitive zone to understand their catastrophic coverage needs. Using a % of the dwelling coverage as a deductible and on an inverted high-to-low scale only add to the confusion.

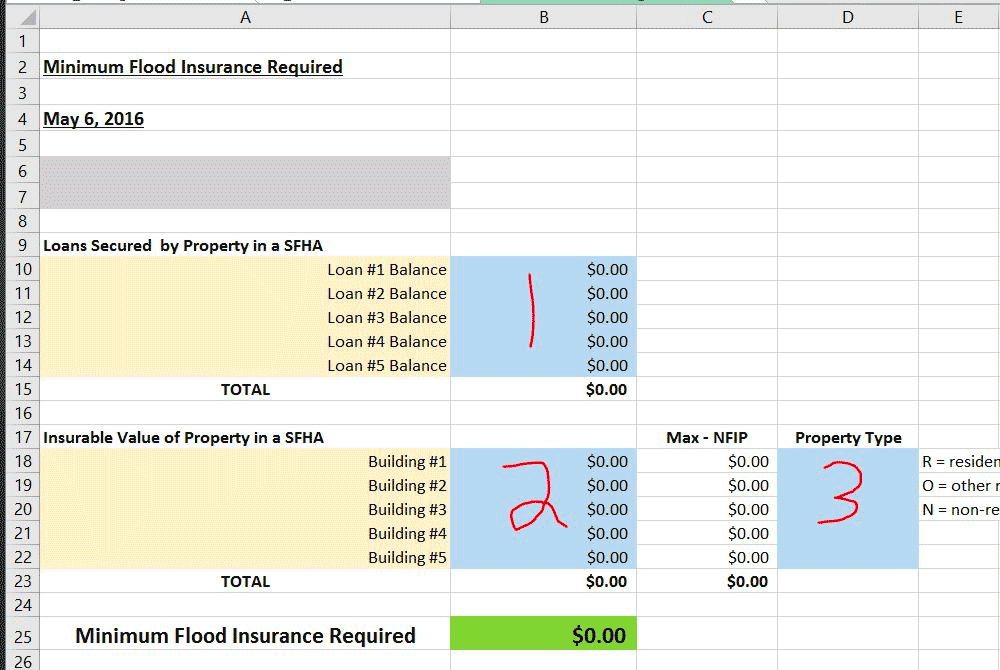

Minimum Flood Coverage Calculator

by Banker's Online

Similar to the Fannie Mae calculator, but in a more platonic calculator user interface: a spreadsheet. It provides a data dictionary upfront with the spreadsheet download and a picture (!!) of the spreadsheet as a preview.

Does the job, provides great calculation transparency, doesn’t have weird UI bugs. One thing to watch for is that if the National Flood Insurance Program coverage rules or limits change the sheet might not be automatically updated– though this is true for almost all calculators in this review.

Flood Insurance Price Estimator

by the Virginia Department of Conservation & Recreation

This Virginia DCR grant-funded calculator from GetFloodFluent.org has a lot going for it. It shows an actual price estimate, lets you update your answers after filling out the form, and provides a progress bar. Everything from here on out is a nit since, again, it provides a price estimate.

The nitpicks here come from a few bugs:

1) One of the two transformation inputs (building coverage) doesn’t allow a value larger than $250,000. But instead of explaining this the calculator lets you proceed with no error. Then it reduces the number– with no explanation– in the final risk-price presentation. Unclear if this is a bug with the software used to set up the calculator (typeform) or a missing piece of business logic.

2) The contrast when items are selected from a dropdown feels high (it shifts to the red-wine-gradient background) and the transitions, while buttery, are over the top for a tool that might work in a drier style like the Bankers Online or Fannie Mae calculators.

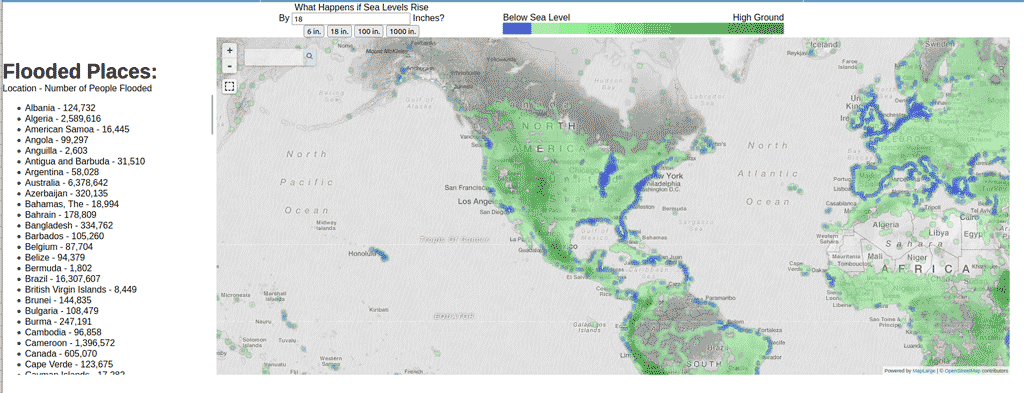

Global Flood Map

The global flood map has promise, and brings attention to the horrific problem of displaced people who will be affected by global-warming-induced floods.

But it also has some serious problems: the “below sea level -> high ground” key isn’t well explained, some of the missing elevation data could be better manicured away. It could also stand to provide a data layer that showcases the human displacement on the map as opposed to just sea level above or below.

Design sins aside, it also provides no https (secure) version of the site which is why we don’t link it directly. But the number of people flooded list, the table updates based on your sea-level input choice, is stark.

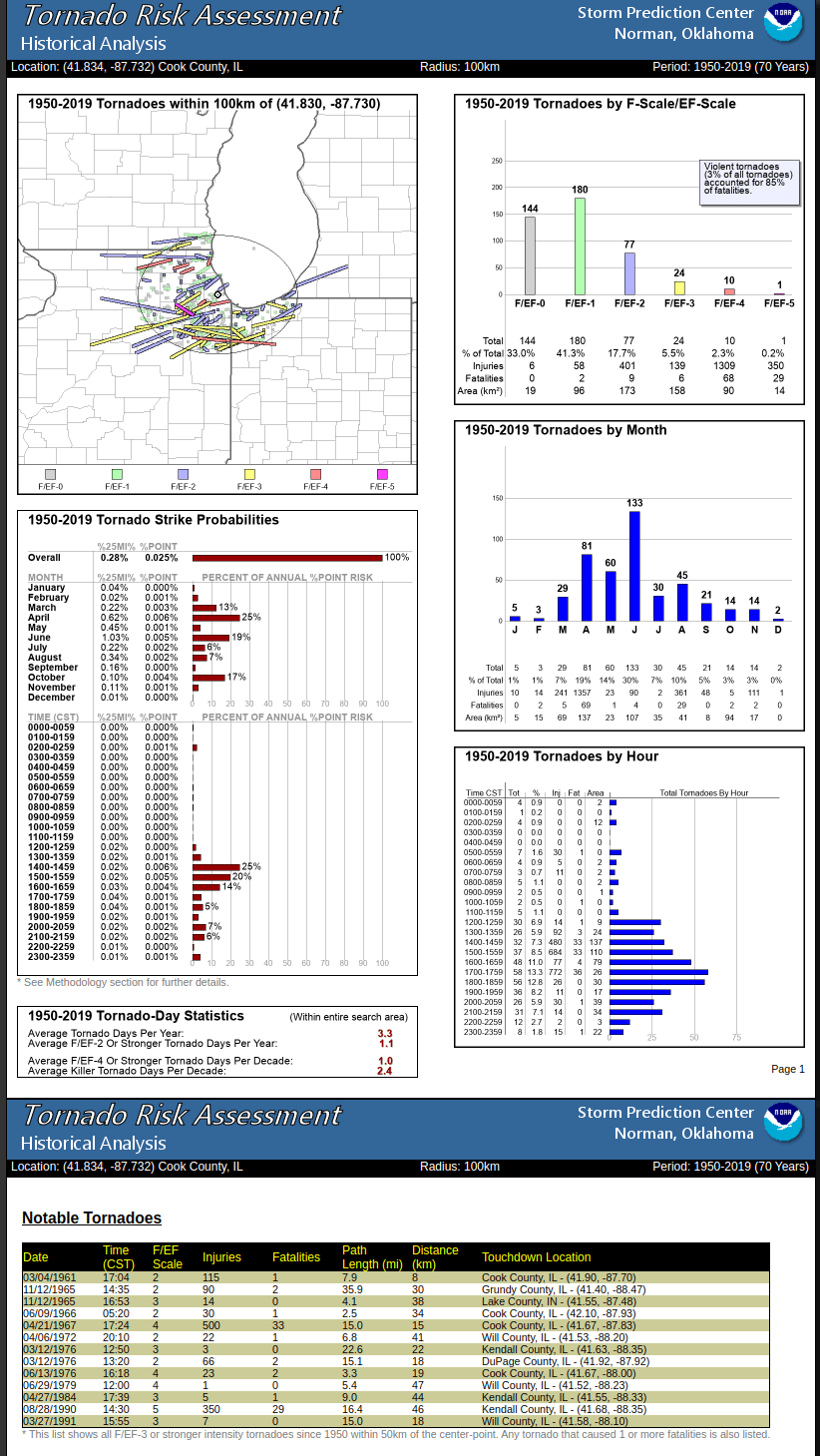

Tornado Risk Calculator

by SPC NOAA

This tornado risk calculator built by John Hart @ NOAA is focused on modeling the cost in human life of tornados based on their location. It provides a more complex set of outputs so that risk planners of various types can help reduce the threat of tornadoes to human life based on a location and tornado strength.

Our only suggestion here might be that, depending on the intended consumer of the data it might be easier to slim down the input choices to only the location then provide a range of models based on tornado strength (or at least providing sensible defaults around these), but it is likely that the intended user is better-versed in what inputs to choose and how.

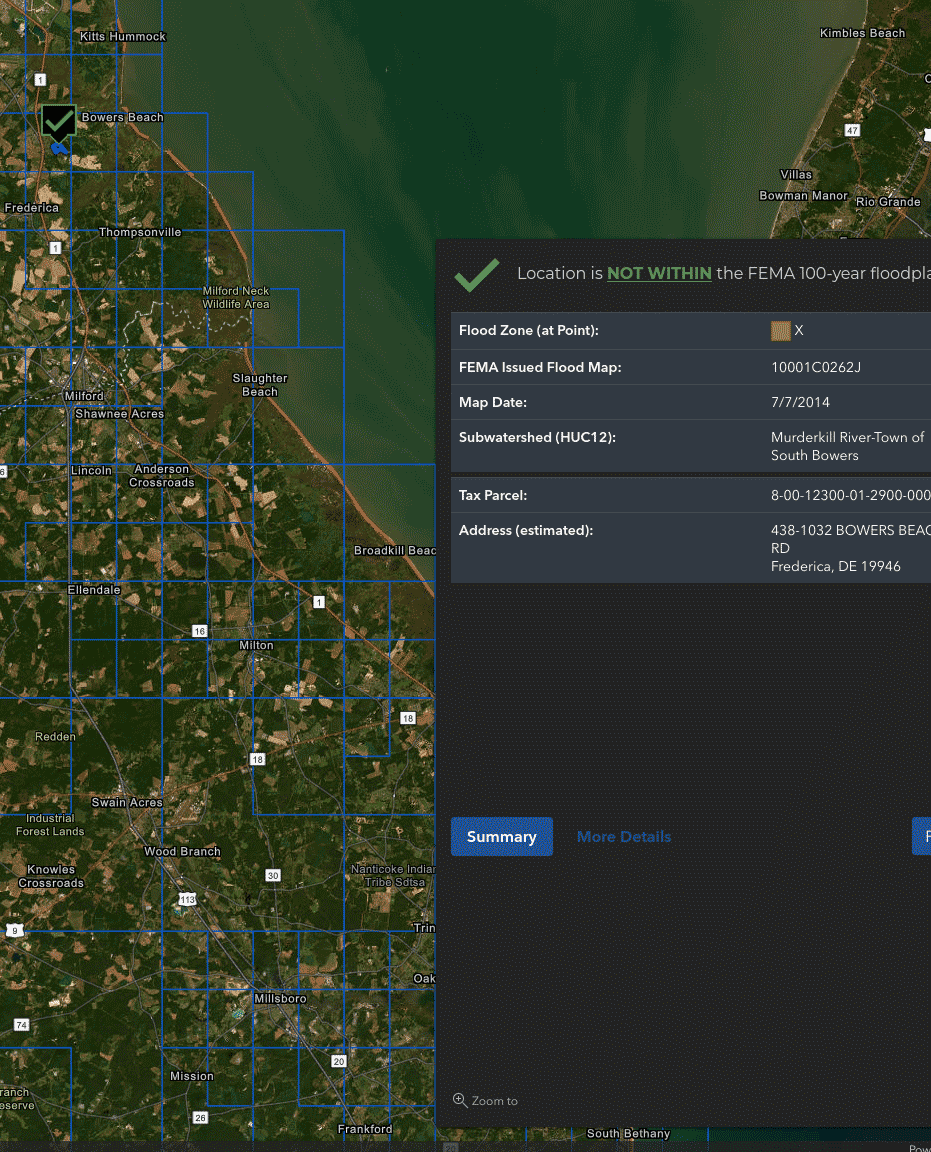

Flood Planning Tool

by Delaware Natural Resources & Environmental Control

With the satellite images of Delaware covering most of the screen, it's definitely one of the most eye catching risk tools in the set. It takes a location as input and outputs a Yes/No on whether its in a 100-year floodplain when cross-referenced with a FEMA map.

It does this well. It’d be nice if the Yes/No decision popped a bit more in some cases (you can see how the blacks and greens can blends in depending on the background of the map). Otherwise great, if slightly overstimulating, tool.

Copyright © 2024 Coverage Cat. All rights reserved.

Built with ♥ in 🗽

Coverage Cat, Inc. is a licensed insurance broker (or producer). In California Coverage Cat does business under the name Coverage Cat Insurance Services. Coverage Cat’s license numbers are listed here. Coverage Cat places insurance with a number of insurance companies, each of which is not an affiliate of Coverage Cat.