How to Buy Insurance / Insurance gives a poor return

If Vanguard Sold Insurance

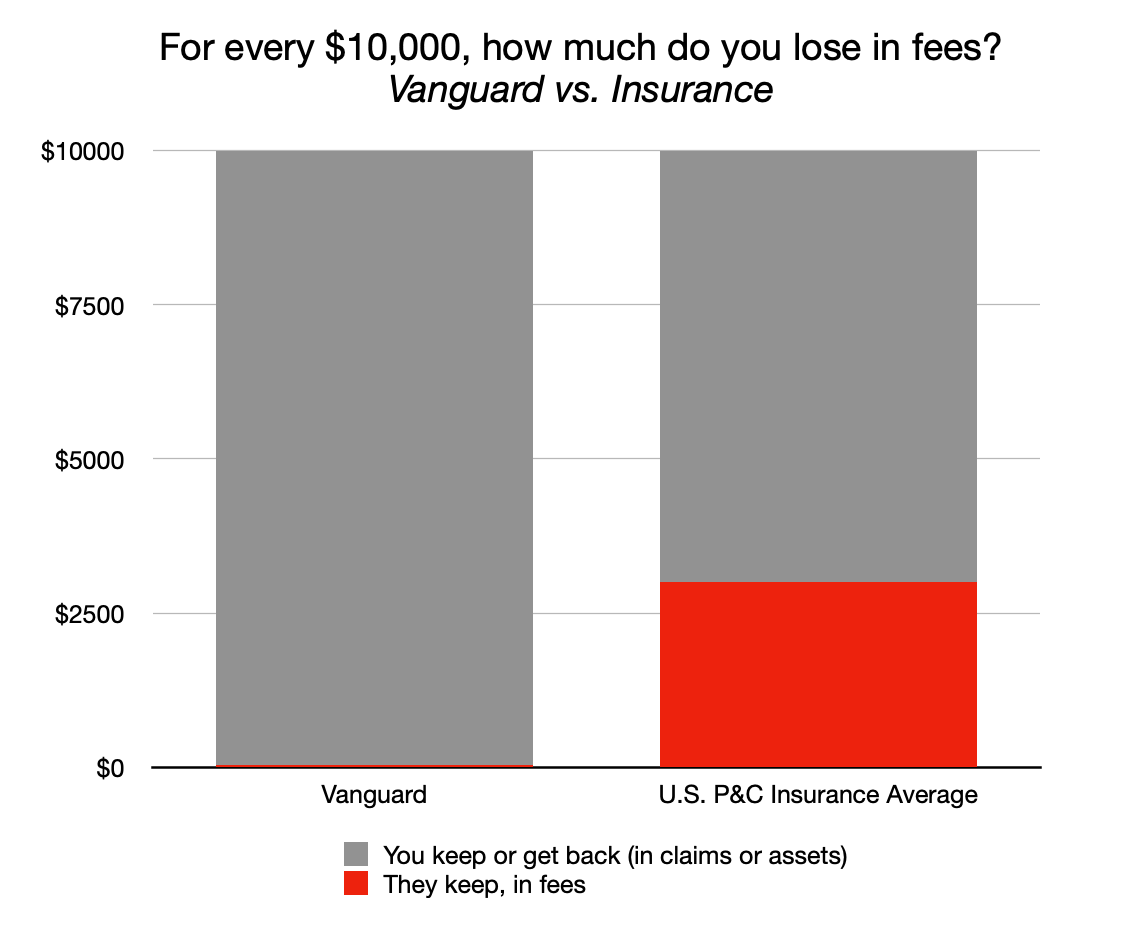

For every $10,000 you spend on insurance premiums, you pay $3,000 in “fees.” Let that sink in.

Written by: Max Cho Reviewed by: Max Cho, Licensed Insurance Broker NPN 20377411

Vanguard’s a famously low management fee company. For every $10,000 you put in their total stock market fund, you pay an astoundingly low $4 in fees. By comparison, for every $10,000 you spend on insurance premiums, you pay $3,000 in “fees.”

That’s not a typo: in 2020, 30% of insurance premiums were spent paying for salespeople to call you, television ads to yell at you, referral fees and kickbacks, and other insurance overhead. [III, U.S. Property & Casualty, 2020]

This sad fact has led to a joke within the industry: “Insurance is not bought, it is sold.” No one has ever woken up excited to buy insurance — for most people, it’s a begrudging requirement with a bewildering process teeming with “call for a quote” salespeople and byzantine online forms.

Ned Ryerson epitomizes insurance sales-first culture: “Do you have life insurance? Because if you do, you could always use a little more.”

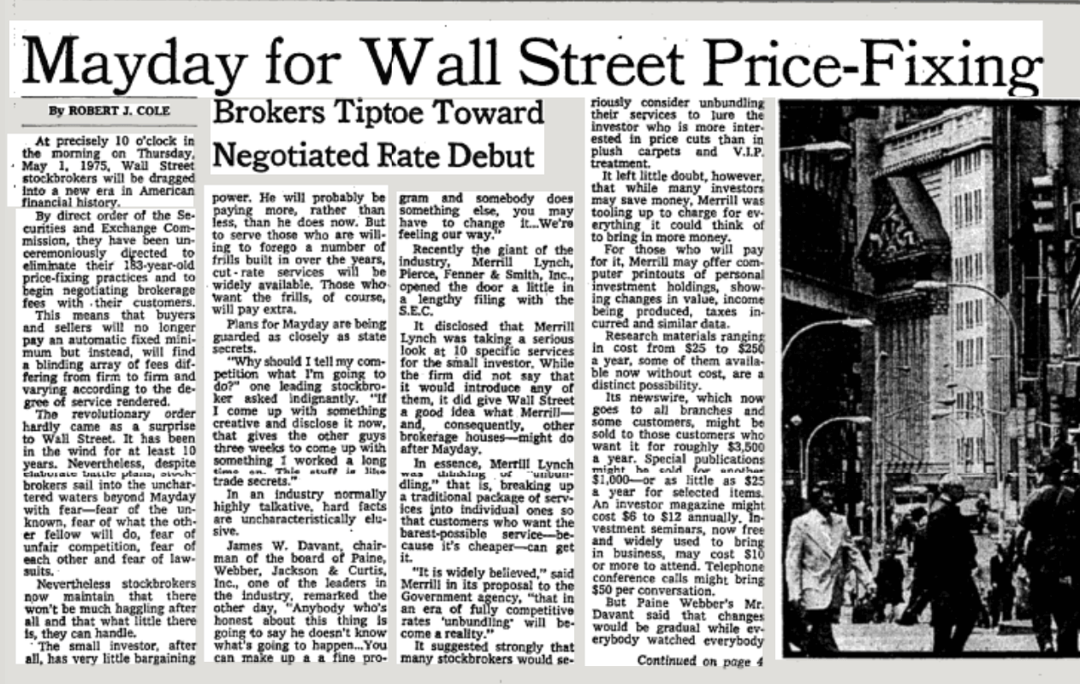

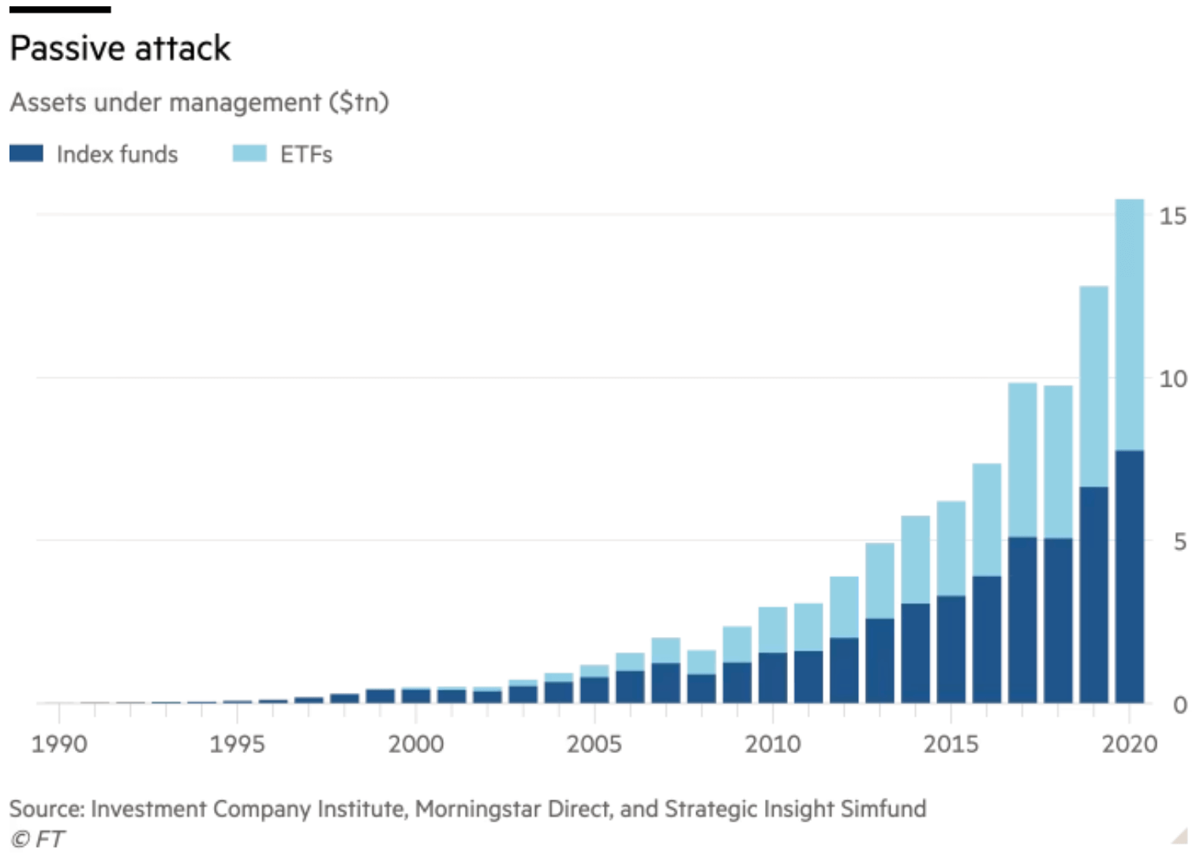

Of course, the stock market used to be crowded with similar high-commission salesmen.

Back then, even outside of scammers like the Wolf of Wall Street, the commission situation was brutally expensive — brokerage fees before 1975 were a price-fixed 2% commission (50x higher than Vanguard!).

When that price-fixing ended, The New York Times erroneously predicted the little guy would get screwed. “The small investor, after all, has very little bargaining power. He will probably be paying more, rather than less, than he does now.” Instead, fees sharply declined, and today the small investor is paying less in fees than ever before.

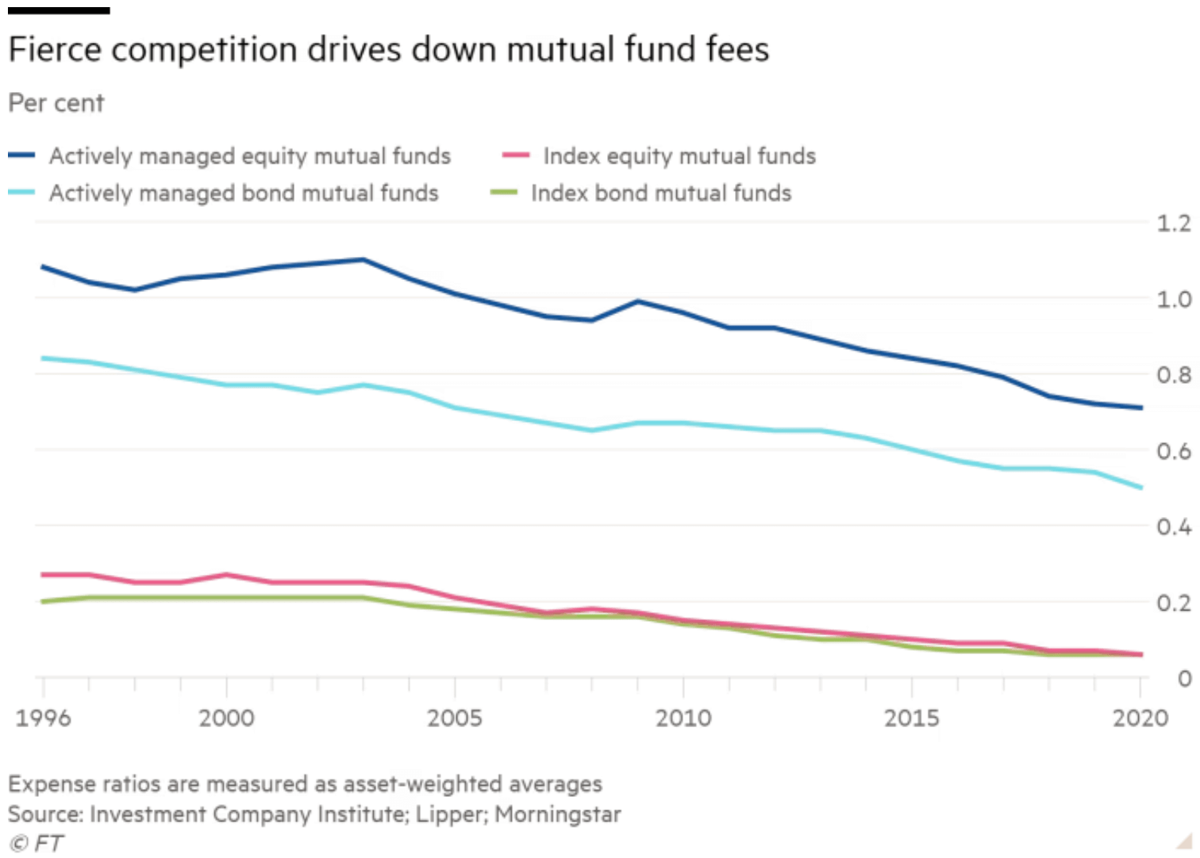

This transformation didn’t happen by accident. Vanguard pioneered and popularized it by creating a better product.

Over the past 50 years millions of people switched, and today low-fee mutual fund & ETF investing is the dominant smart choice.

The world will be a better place when insurance is transformed the way Vanguard transformed investing. The average American spends thousands of dollars a year on insurance, with most buying a product they don’t understand, that costs them massive fees, and enriches thousands of high-commission middlemen in the process.

Hate wasting money? Buy as little insurance as you can — get coverage only for catastrophes.

Coverage Cat wants to do the insurance market what Vanguard did for stocks. We don’t maximize commissions or sell you insurance you don’t need. We aim to give you the best insurance for your specific risk tolerance & wealth.

Copyright © 2024 Coverage Cat. All rights reserved.

Built with ♥ in 🗽

Coverage Cat, Inc. is a licensed insurance broker (or producer). In California Coverage Cat does business under the name Coverage Cat Insurance Services. Coverage Cat’s license numbers are listed here. Coverage Cat places insurance with a number of insurance companies, each of which is not an affiliate of Coverage Cat.