How to Buy Insurance / No one likes shopping for car insurance. Simplify your life and lower your premium with Coverage Cat’s tools and tips for better insurance.

Shopping for Car Insurance in Texas? Try These Tips

Texas drivers are feeling the sting of rising car insurance rates, even without accidents or claims. To help ease the pain, check out Coverage Cat’s top tips for shopping around and saving money.

Written by: Jazzmin Lu Reviewed by: Max Cho, Licensed Insurance Broker NPN 20377411

Hey, Texas drivers! Did your car insurance rates just skyrocket?

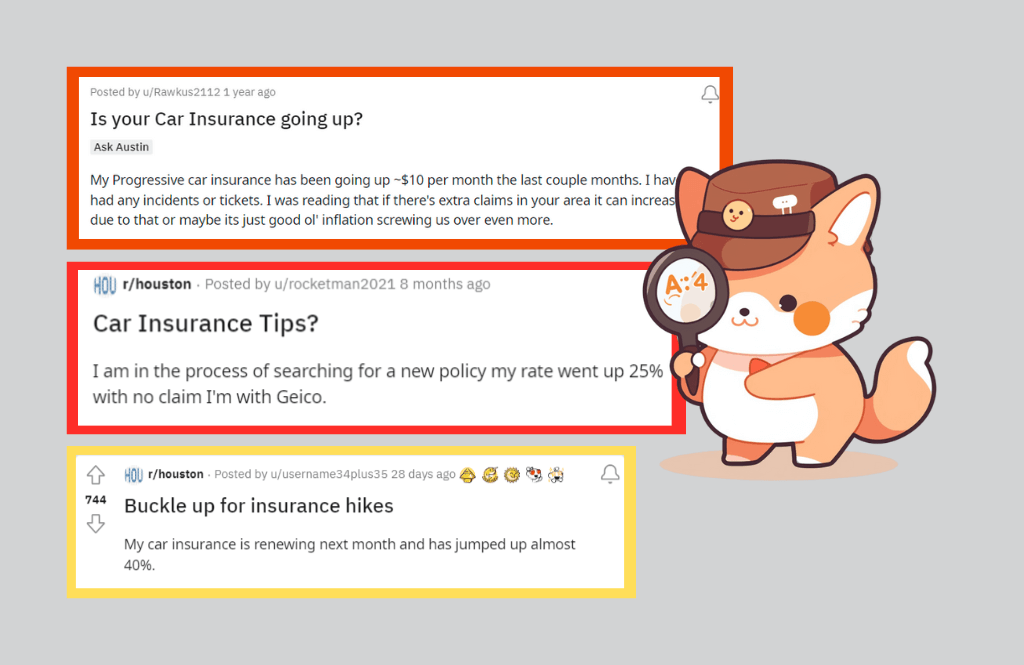

It’s not just you – according to the Texas Department of Insurance, policies increased an average of 20% at the beginning of 2023 – with some companies increasing rates by 30%. Anecdotally, we've seen posts all over social media sites like Reddit and Twitter with complaints about expensive premiums and astronomical renewal prices in cities like Houston, Austin, and Dallas.

Whether you’ve been looking for a new policy or just wondering if shopping around is worth the effort – we want to offer some tips and tricks for making the process a little less painful.

Problem: Insurance prices aren’t clear.

If you haven't had any accidents or claims, getting a big renewal increase can be a headscratcher. You might also be quoting and feeling puzzled as to why every company seems to believe that your car's comprehensive and collision coverage should cost as much as a Lamborghini's, even though you drive a reasonable sedan.

Solution: Unfortunately, there are many reasons besides your personal driving history that affect your rates. Anything from inflation (which affects repair and replacement costs) to increased thefts in your area could drive up your prices. Since you can’t always change those factors, focus on what you can control with these tips.

- Shop around regularly (once or twice a year).

- Remember that even if you accidentally renewed or didn’t have time to shop around right when your renewal happened, you’re not locked into your policy. You can cancel anytime, for any reason (and get all or most of your money back).

- Check out our Cheapest Car Insurance in Texas guide see what actual prices are being quoted for Texas drivers.

- Use Coverage Cat's price and coverage calculator to see what prices you should be paying for your specific car and coverage.

- Get your annual CLUE report! A CLUE report is like your credit report, it tells insurers about any accidents or claims on your record so they can adjust your price. Even if you know you're accident-free, insurance companies do make mistakes and checking this report can help you clear up any false reports or errors.

Problem: Online comparison isn't easy.

There are countless online comparison sites promising fast and easy solutions. Usually they take your info, offer zero prices, and leave you with the sinking feeling that they've sold your name and email. Or maybe you've visited several insurance company websites, only to end up with a screen telling you to call for a price. Either way, you're left without any prices or anything to compare.

Solution: Work with a licensed insurance broker. Unfortunately, insurance companies don't have too much incentive to make prices easy to compare online. They know they're selling complex products that most people don't understand (more on that below), and showing you prices online gives them less control over the sales process. While you can still find good prices with online quoting, it can be difficult and time-consuming. Working with an independent broker, however, gives someone else the work and helps protect your information from shady sites. Coverage Cat is a licensed agency and brokerage that works entirely online. You fill out one easy form and we communicate with you via email to find you the best policy (no calls!). But if you're interested in selecting from a wide range of traditional insurance agents and brokers, the Texas Department of Insurance maintains a comprehensive list of options for all your insurance needs.

Problem: You don't understand what you're buying.

Insurance isn't exactly fun to purchase or use, but it plays a vital role in protecting you. Maybe you can afford to pay for a small repair if your car gets damaged, or maybe you could even afford to replace your car completely, but what about replacing someone else’s brand new car? Or paying hospital bills for a family with major injuries? Knowing what you're buying can make you a smarter shopper by ensuring you're not paying for unnecessary protection or missing out on coverage that could benefit you.

Solution: If you want to learn why car insurance is so confusing, what kind of coverages you need, and how to buy check out our Car Insurance Buying Guide. Or, skip the hassle and let Coverage Cat figure out what insurance works best for your financial needs!

Copyright © 2024 Coverage Cat. All rights reserved.

Built with ♥ in 🗽

Coverage Cat, Inc. is a licensed insurance broker (or producer). In California Coverage Cat does business under the name Coverage Cat Insurance Services. Coverage Cat’s license numbers are listed here. Coverage Cat places insurance with a number of insurance companies, each of which is not an affiliate of Coverage Cat.