How to Buy Insurance / This becomes an even greater financial flywheel add as one moves up the financial ladder giving each dollar of premium savings additional leverage when invested.

How The Rich Buy Insurance

The capacity to self-insure, and effectively turn wealth into more wealth, is the main way that the rich leverage their insurance advantage.

Written by: Gabriel Botelho Reviewed by: Max Cho, Licensed Insurance Broker NPN 20377411

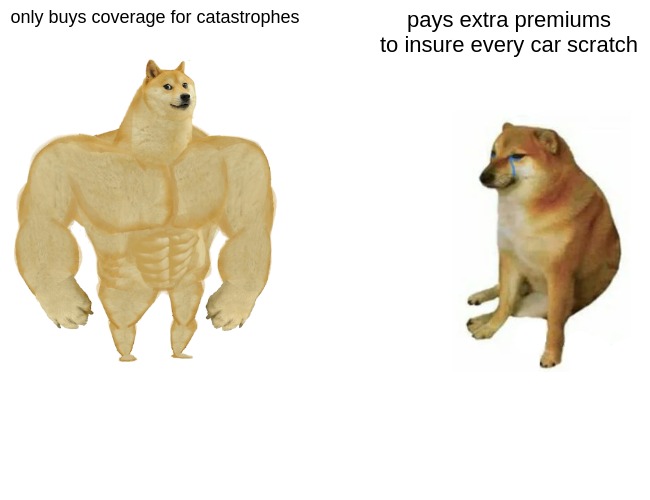

In short, self-insure as much as possible to avoid paying unnecessary premiums to insurance companies that are often better at assessing risk than the average person. It’s well-known that the ultra-rich operate under significantly different financial circumstances than the rest of us, but what’s less well-known is that their approach to insurance is one that can be used to help preserve and improve most peoples’ personal finances. The capacity to self-insure, and effectively turn wealth into more wealth, is the main way that the rich leverage their insurance advantage. The point here however is that even though the wealth generated might be marginally less for someone who is not an ultra-high-net-worth-individual, the same basic principles still apply. Self-insure for the things you can afford to replace and spend your insurance budget on risks that threaten catastrophic damage to your wellbeing, financial or otherwise. To belabor the point, the recognition that the ultra-rich they can afford to replace almost any house, car, property, or pay most liabilities related to the costs of said property ownership allows them to take the money that would otherwise be spent on insurance premiums and continue to reinvest it yielding steady returns over time, that compound wealth. This becomes an even greater financial flywheel add as one moves up the financial ladder giving each dollar of premium savings additional leverage when invested. While opportunities like real estate, tax-loss harvesting, significant diversification, additional leverage per dollar, and unique investment opportunities (e.g., private equity and venture capital) are not always accessible to normal investors; the additional dollar can also prove to be more valuable at the margin. That is, an extra dollar of savings in an emergency fund, HSA, or college investment savings account from premium saved has the potential to be far more impactful than yet another coin in a Scrooge McDuck vault.

Copyright © 2024 Coverage Cat. All rights reserved.

Built with ♥ in 🗽

Coverage Cat, Inc. is a licensed insurance broker (or producer). In California Coverage Cat does business under the name Coverage Cat Insurance Services. Coverage Cat’s license numbers are listed here. Coverage Cat places insurance with a number of insurance companies, each of which is not an affiliate of Coverage Cat.